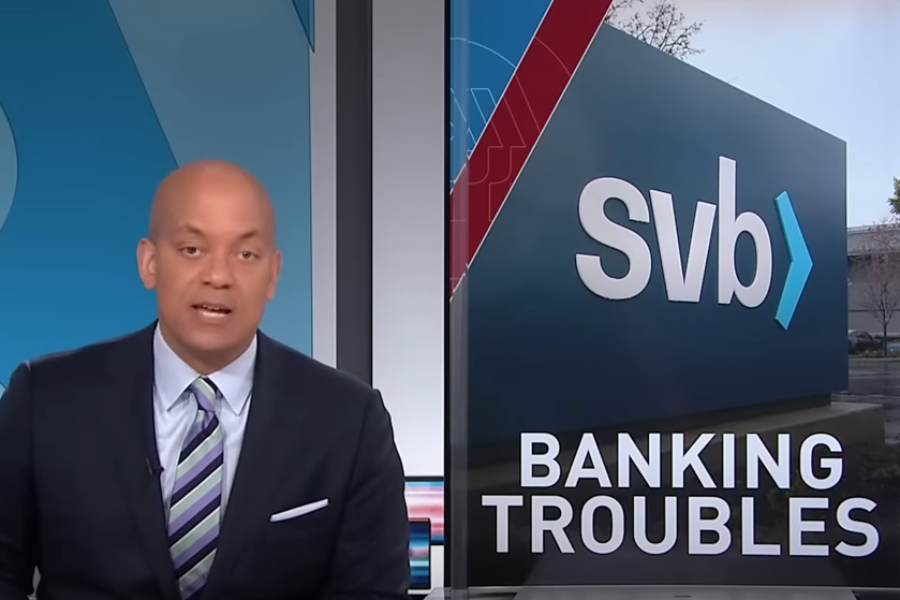

The collapse of Silicon Valley Bank (SVB) may have significant implications for the technology industry, which in turn could have a significant impact on the real estate market. Silicon Valley Bank had been a key financial institution in the technology industry providing funding and support to many startups and tech companies.

One impact will probably be a decrease in demand for commercial real estate and housing in the Silicon Valley region. It could also lead to a slowdown in the tech industry resulting in job losses and fewer people looking for homes and office space It’s conceivable that it might put downward pressure on real estate prices.

It’s difficult to predict the full extent of the impact on markets outside of Silicon Valley. Currently, the collapse of Silicon Valley Bank has raised concerns about the banking industry as a whole. High-interest rates and fear of a recession compounded with fears of contagion in banking aren’t the best optics right now.

The risk of contagion in banking also referred to as systemic risk, is that financial difficulties at one bank(s) could spill over to a large number of other banks or financial systems as a whole.

March 27, 2023 (Reuters reported that U.S. regulators said on Monday they would backstop a deal for regional lender First Citizens BancShares to acquire failed Silicon Valley Bank, triggering an estimated $20 billion hit to a government-run insurance fund.

The deal comes after the Federal Deposit Insurance Corporation (FDIC) took over Silicon Valley Bank on March 10 after depositors rushed to pull out their money in a bank run that also brought down Signature Bank and wiped out more than half the market value of several other U.S. regional lenders.

Only time will tell how this shakes out.

How Did This Happen?