This is a partial re-post from JVM’s Blog of JVM Lending: 925.360.3305

HOW STRIPPERS BOUGHT HOUSES

In the movie The Big Short there was a scene in which a stripper bought multiple investment condos. She was able to do so because there were subprime loans available in the early 2000s that required: 1. No Income Verifications, 2. only a 680 credit score 3. No Down Payment: 4. and no owner occupancy.

So Strippers could speculate in investment condos with no income and no money out of pocket – effectively getting free “put” options. If condo prices went up – woohoo! Strippers got rich! If condo prices went down – darn! Strippers walked away and lost very little.

What could go wrong? Well, we know the answer… The economy was a mortgage broker/stripper doom loop. What may be even more amusing is that those strippers were probably making very good money, as the same mortgage brokers who gave them loans were also spending inordinate amounts of time in those same strip bars, tipping strippers with the money they made providing mortgages for strippers.

ZILLOW ANNOUNCES 1% DOWN

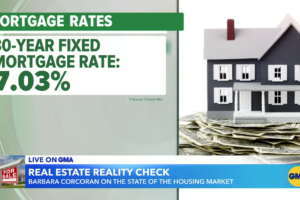

Last week Zillow announced its 1% down loan program, and the internet went wild with comments about how this is a return to the worst excesses of the subprime mortgage days. You’d think we are on the verge of mortgage Armageddon. But alas, we’re not because Buyers need to actually verify income with a real job and real tax returns.

WHAT THE DOOMSAYERS DID GET RIGHT

Small down payments definitely do foster more foreclosure risk. After the 2008 Mortgage Meltdown, many people walked away from their mortgages because they were upside down with negative equity and not because their payments were too high. Given that economists expect housing to appreciate 18% over the next 5 years (per the MBS Highway) it’s unlikely that the 1% buyer will walk. This is particularly the case when the bottom end of the housing market is expected to appreciate the most given the shortages.

Jay Voorhees NMLS 310167 Founder Broker JVM Lending 925-360-3305