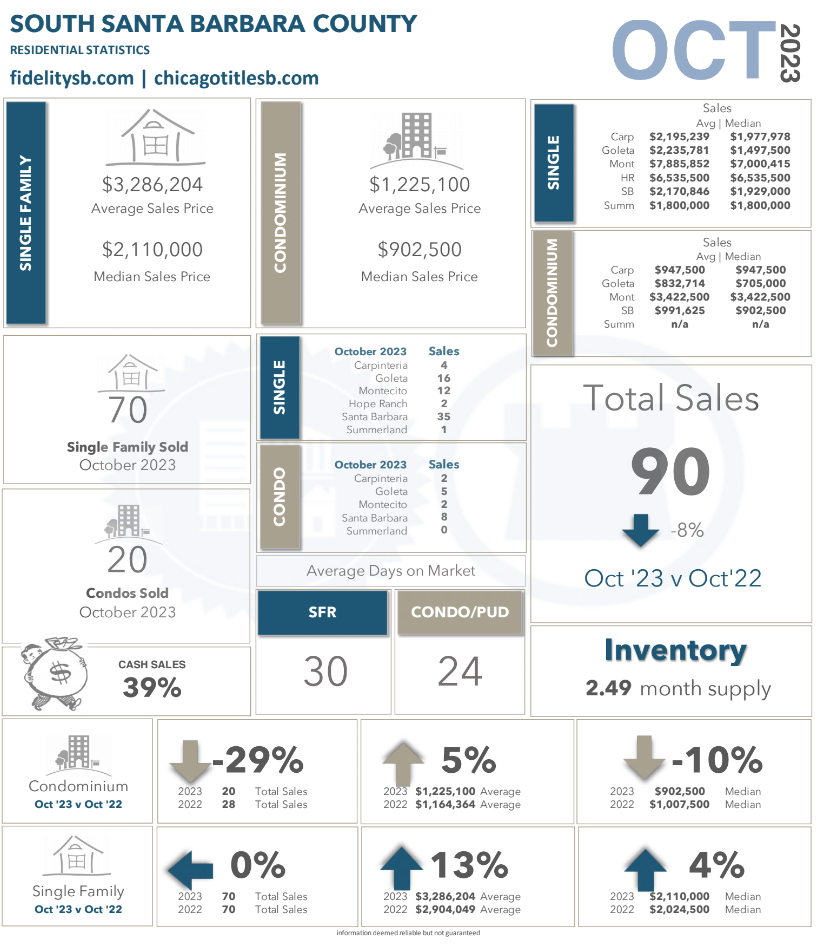

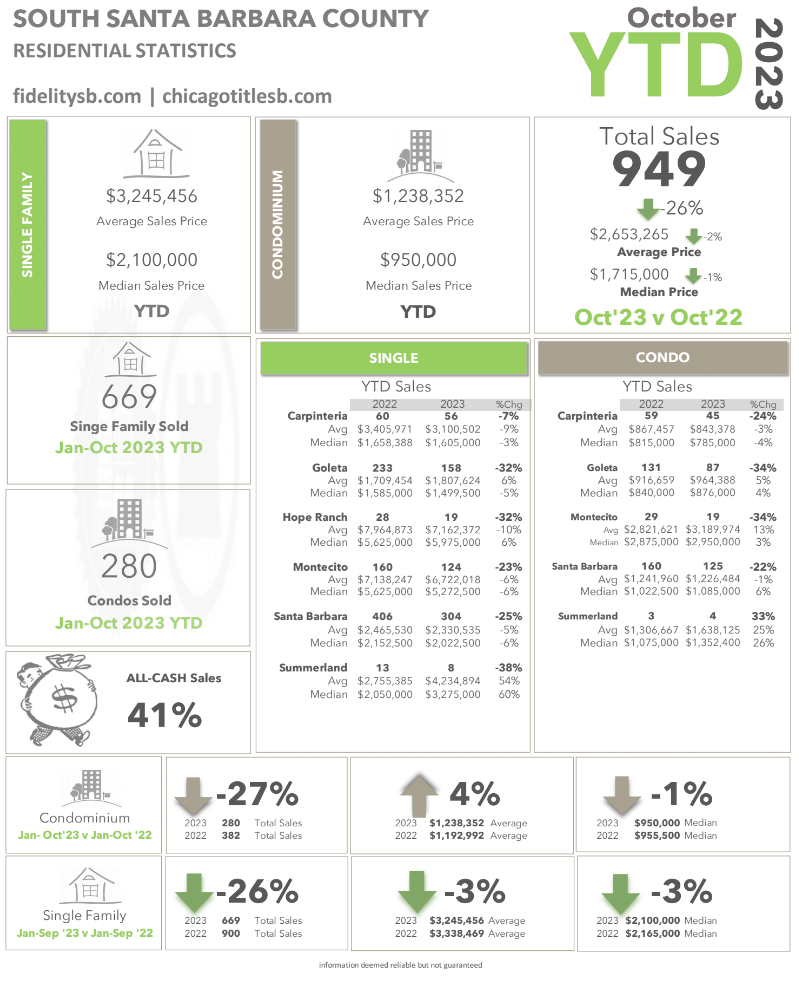

The Santa Barbara Real Estate market continued to reflect trends that have been with us all year: relatively few homes for sale, higher mortgage interest rates, and a gradual cooling from the very hot market we experienced during the height of the pandemic.

Median prices and numbers of sales often flatten or decline in late summer into January compared to spring and early summer months. The market seems to have moved into this pattern. At the same time, continued interest rate increases and other factors are putting pressure on prices, offset to a large degree by a low supply of available homes for sale (inventory).

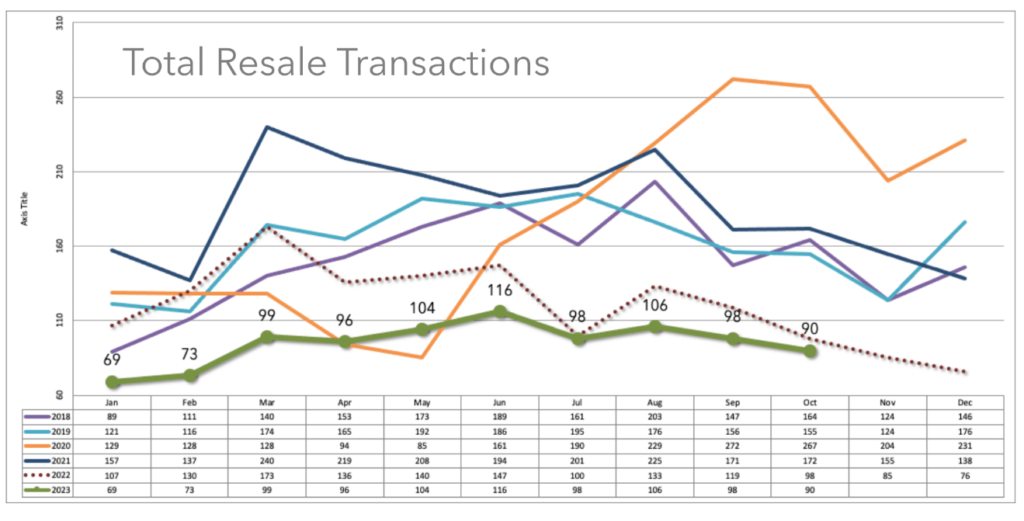

The above graph reflects property sales for Southern Santa Barbara from 2018 to October 2023

Information Provided by Fidelity Title Company of Southern Santa Barbara

MORTGAGE RATES UPDATE NOVEMBER 15, 2023

November 15, 2023, the current average 30-year fixed mortgage interest rate is 7.76%, falling 7 basis points over the last week. If you’re planning to refinance, the average interest rate for a 30-year fixed refinance is 7.92%, decreasing 4 basis points over the last seven days. Meanwhile, today’s national average 15-year refinance interest rate is 7.14%, decreasing 13 basis points since the same time last week.

The California real estate market is one of the most expensive in the U.S. that’s adjusting to higher mortgage rates and rising inflation. However, the Golden State housing market remains healthy in its various regions, including the tech-savvy Bay Area and multi-faceted Southern California.