The Financial Times / Meredith Whitney reported that Freddie Mac wants to enter the secondary home equity loan market in a win-win for the government, Wall Street, and consumers with Mortgage Reform that could unleash the next big U.S. stimulus.

The U.S. housing market is harboring the potential for unprecedented economic stimulus that wouldn’t require any federal spending, according to Meredith Whitney, the one-time Oracle of Wall Street” who predicted the Great Financial Crisis.

Meredith noted that mortgage finance giant Freddie Mac asked its regulator last month to enter the secondary mortgage market, or home equity loans, which allow homeowners to borrow against the equity in their houses. Such borrowing can be used for vacations, weddings, new cars, investments, medical bills, or starting a business. In other words, it’s more money that could power the economy.

Letting Freddie Mac initiate this mortgage reform for home equity loans could start putting $1 trillion into consumers’ wallets as soon as this summer and $2 trillion by the autumn, Whitney estimated. If fellow mortgage giants Fannie Mae and Ginnie Mac follow along, the potential stimulus could top $3 trillion.

Freddie Mac’s second mortgage/home equity mortgage reform, effectively implemented, could be a lifeline for these households, offering them financial flexibility. It sets up guidelines to protect both the borrower and Freddie Mac that may be the template for future moves by Fannie Mae and Ginnie Mae. Freddie Mac will only buy the second mortgages of borrowers that it already has a first mortgage with, and the combined loan-to-value of both the first and second mortgages cannot exceed 80 percent of the property’s value.

Most people in the US are feeling the sting of persistent inflation, but older Americans living on a fixed income have been hit particularly hard. Insurance costs for homeowners have risen over 11 percent over three years while they’re paying more tax. By opening up the securitization market for second mortgages, not only would more institutions be inclined to originate the loans, but the cost to borrowers would meaningfully decline with more finance providers. It would also provide a big stimulus to an economy and consumers that appear to be slowing down without adding to the government debt.

A win-win for the government, Wall Street, and the US consumer.

The State of Mortgage Rates and the DeCoding of the Real Estate Market

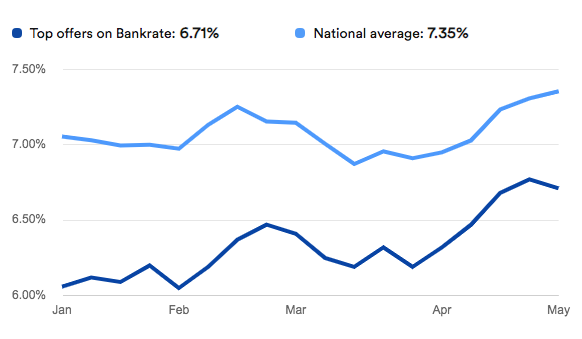

Monday, May 06, 2024, the current average 30-year fixed mortgage interest rate is 7.34%, rising 2 basis points from a week ago. If you’re looking to refinance your current loan, today’s average interest rate for a 30-year fixed refinance is 7.34%, increasing 1 basis point from a week ago. Click the image below for more information.