Creating a plan If you plan on downsizing during your retirement years, you have a lot to think about. That includes what to do with your current home before you transition to a smaller one, but this doesn’t have to be a stressful decision. As long as you take the right steps and have the right experts to help you, you can come up with the right plan for your home and your move.

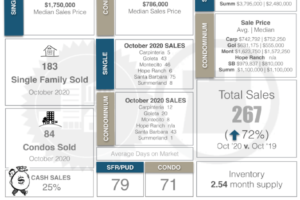

Understanding Your Home’s Value Your home is likely one of your most valuable financial assets. To understand just how valuable that asset is, you should use a PennyMac home value calculator. Using these sort of online tools to estimate your home’s current value will give you a better idea of whether selling it, renting it, or leaving it to your loved ones makes more sense. Just keep in mind that while sites like PennyMac can be helpful for researching recent sales and even securing financing for your new home, these numbers are only estimates. To get a clearer picture of what your property is worth, as well as local real estate trends, you need an experienced real estate agent.

Plan Your Downsizing Process Moving homes can be very stressful, and moving after living in the same home for several years can add even more emotional tension for seniors who are downsizing. So before you decide what will happen with your home, you should create a downsizing plan that helps reduce the tension around your eventual move. Your plan for downsizing should include essential steps, like sorting through your belongings, but it should also include stress-reducing strategies, like hiring movers. Using tools provided by HomeAdvisor, you can see that hiring movers will add around $1,062 to your budget, but you can also find top-rated companies to manage your move. Keep in mind that moving greater distances will increase that figure; moving across the country, for instance, could easily bump that up to $1,000 per room.

Consider Your Rental Potential If you’re not quite ready to sell your home, you may be interested in renting it out. If you take the proper steps, renting out your home can actually provide a decent stream of income, and hiring a property manager can help offset some of the pressures around owning a rental property. With or without a property manager, you need to research local rental trends and determine any added costs of turning your home into an investment property. Those costs can include regular maintenance but they can also include special insurance and tax penalties.

Talk to Your Family Members Leaning on trusted family members for support can come in handy when you are trying to decide what to do with your home during a downsizing move. If you are thinking about leaving your home to your loved ones or gifting it to them now, discussing these options with the intended recipients is even more important. Real estate gifts can provide some serious financial assets to your family, but they can also come with stiff tax penalties if you are not careful. So, it’s crucial to determine whether your loved ones want to keep your home or if they plan on selling.

Work with Your Real Estate Agent The last (and often most popular) option for managing your current home when you are also planning a downsizing move is to sell it. Selling your home can be a complex process, especially when you are also buying a smaller one, but working with an experienced real estate agent can make this balancing act far less stressful. Using the same agent can make things even less complicated, especially if you are planning a local move, so make sure you find a real estate agent you are comfortable with from the start.

Downsizing can be a complicated process but deciding what to do with your old home doesn’t have to be. Start by working with a local realtor that you know and trust, and you can make this decision a simple one, but you can also use the steps above to minimize your stress.

This post was written by Jim Vogel Elderaction.org jim@elderaction.org