As mortgage rates continued their slide this week, lenders faced new challenges as they try to keep up with refinancing demand and cope with costly margin calls as a result of the Federal Reserve’s increased buying of mortgage-backed securities.

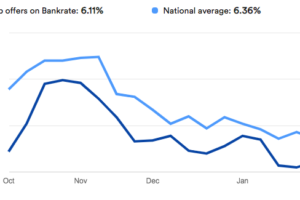

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average sank to 3.33 percent with an average 0.7 point. (Points are fees paid to a lender equal to 1 percent of the loan amount and are in addition to the interest rate.) It was 3.5 percent a week ago and 4.08 percent a year ago. In the past month, the 30-year fixed rate has fallen to a record-low 3.29 percent, rebounded to 3.65 percent two weeks later and now gone back down.

The federally chartered mortgage investor aggregates rates from 125 lenders across the country to come up with national average mortgage rates. It uses rates for borrowers with flawless credit scores. It is important to note the rates quoted are not available to every borrower.

The 15-year fixed-rate average dropped to 2.82 percent with an average 0.6 point. It was 2.92 percent a week ago and 3.56 percent a year ago. The five-year adjustable rate average rose to 3.40 percent with an average 0.3 point. It was 3.34 percent a week ago and 3.66 percent a year ago.

April 2, 2020

Santa Barbara Homes and Estates