To help you better understand today’s real estate markets and property values this post takes a look at the macro and micro factors that affect real estate. Housing markets are made up of statistical averages and prevailing trends. Here are some insights into the Micro and Macro factors that influence property values and market trends.

Macro Factors:

- Demographics: Composition of population such as age, gender, race, income, and population growth.

- Interest Rates: Mortgage Interest Rates change frequently. When mortgage interest rates drop the demand for homes increases as when rates go up it means higher mortgage costs.

- Economy: The GDP, employment rates, cost of goods, and other economic indicators also affect real estate prices.

- Government Policies: Tax credits and other incentives from the Government can have an effect on real estate so investors need to stay alert to any changes.

Micro Factors:

- Location: Homes near good schools, sporting venues, shopping hubs, public transportation, and homes on waterfronts typically are more expensive.

- The Name of your Road? Yup, the name of the road the property stands on also has an impact on its price. The names “street”, “terrace”, and “courts” are found to have lower values than “King” or “Queen” in their road name. Meanwhile, royal roads with the highest value have “Elizabeth” in their names.

- Curb Appeal: Properties in tree lined roads can climb up to 15% more in values while homes surrounded by trees like wisterias can have a 5% added value.

- Historical Plaques: Blue Plaques add historical interest to a property, hence it’s value can increase up to 3 to 5% more.

- Energy Efficiency: Homes with an A energy efficiency rating can have an increase in value by up to 14%

Key Takeaways: There are a number of factors that impact real estate prices, availability, and investment potential:

- Demographics provide information on age, income, and regional preferences of actual potential buyers, what percentage of of buyers are retirees, and what percentage might buy a second or vacation home.

- Interest rates impact the price and demand of real estate. Lower rates bring in more buyers, reflecting the lower cost of getting a mortgage, but also expand the demand for real estate, which can drive prices up.

- Real Estate Prices often follow the cycles of the economy, but investors can mitigate this risk by buying REITs or other diversified holdings that can withstand downturns in the economy.

- Government Policies and Legislation, including tax incentives, deductions, and subsidies can boost of hinder demand for real estate.

Some of the information for this post came from EpicProfessionals.com and Investopedia.com

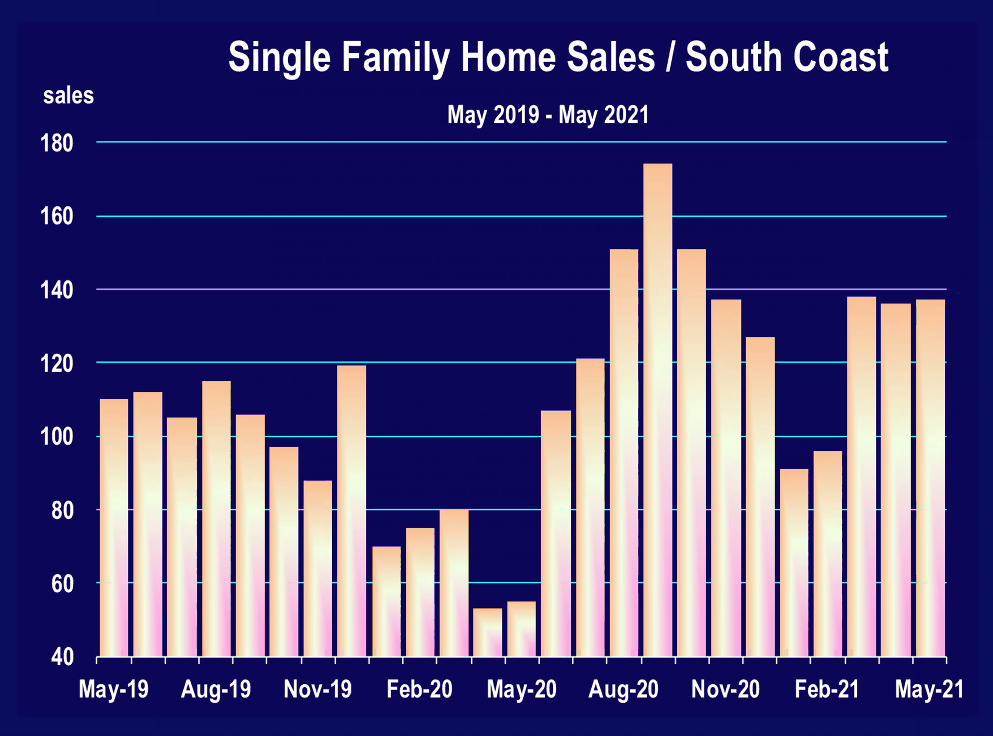

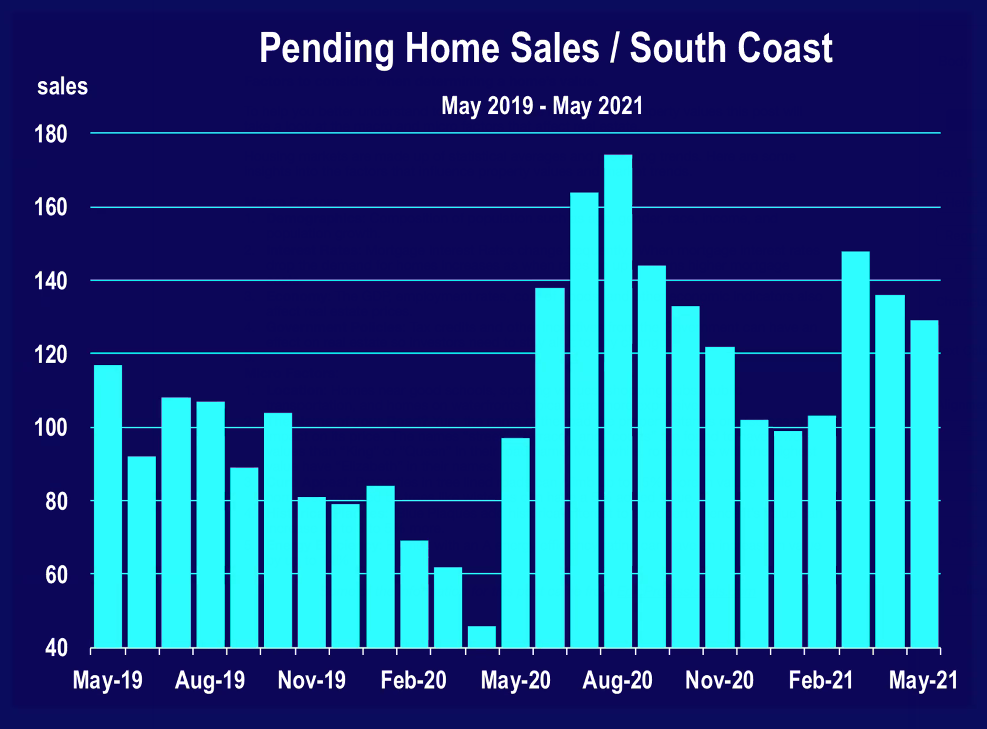

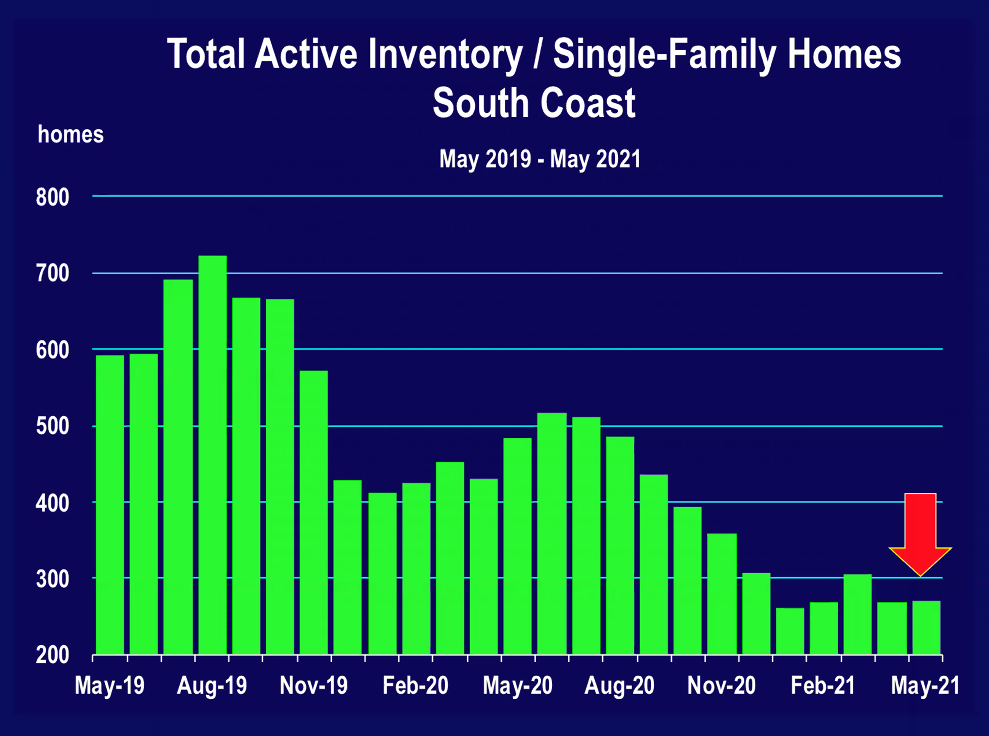

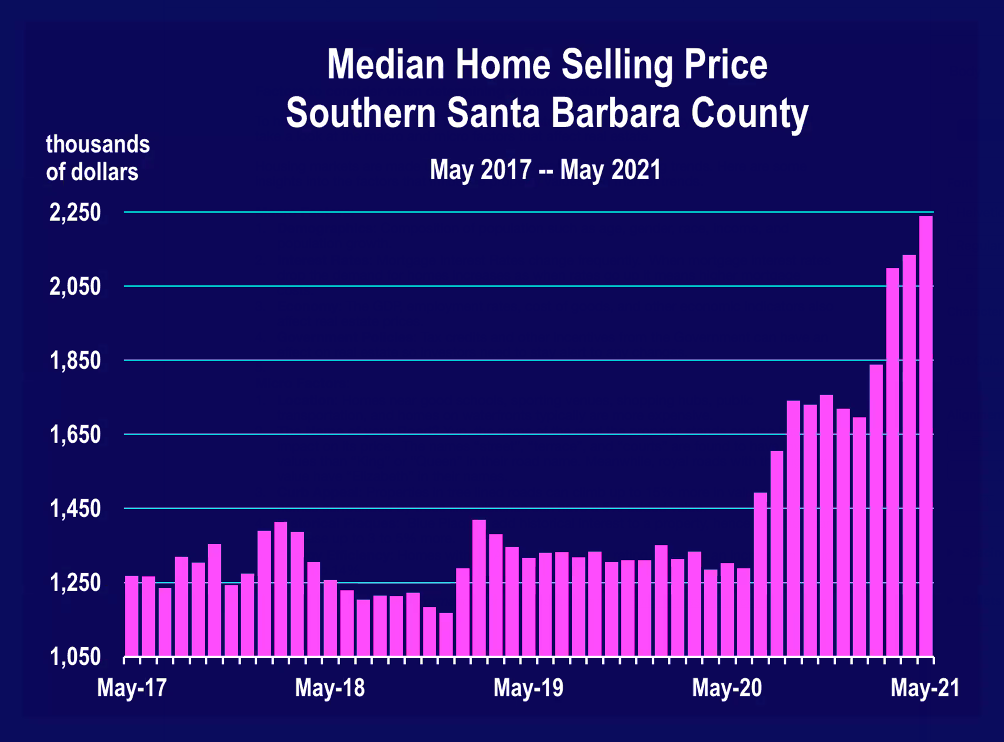

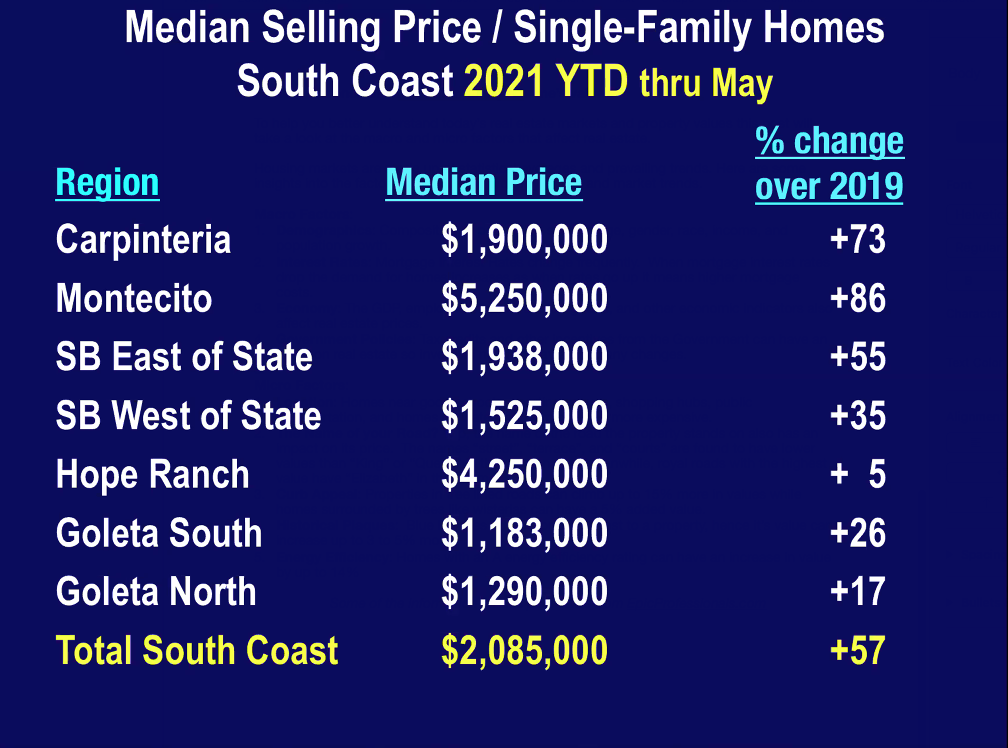

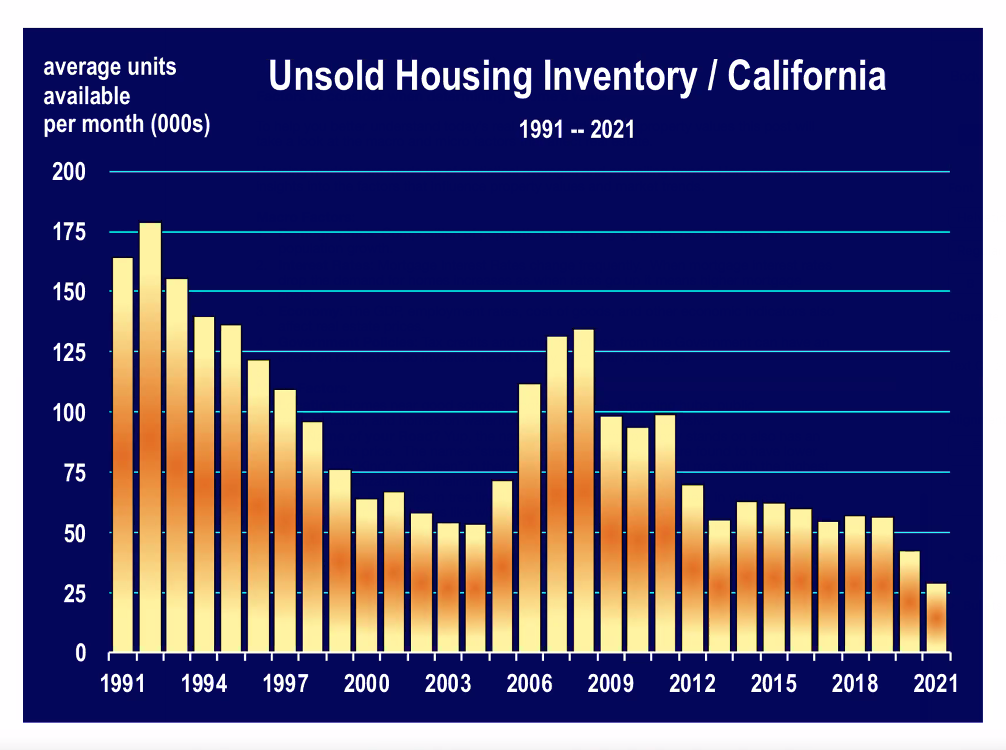

MARKET STATISTICS FOR SANTA BARBARA, CALIFORNIA

This morning on the Santa Barbara Association of Realtor’s Monthly Zoom conference Santa Barbara economist Mark Schniepp provided the following statistics and graphs. Possibly the most interesting comment Mark made today, June 10, 2021, was that “current home prices were unsustainable.”