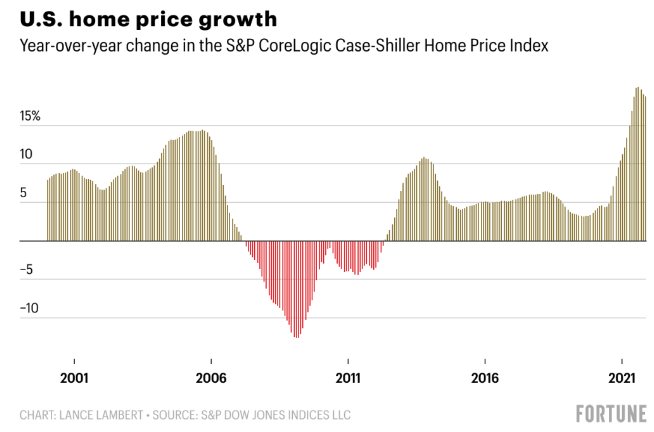

Homeowners Hit Gold During the Pandemic. Since the beginning of 2020, the nationwide median home list price is up 27%—adding $9.1 trillion to the total value of the U.S. housing market in 2021 alone. Source/link: Fortune

Robert Shiller, ” Home Prices will fall and cause some pain.”

Homebuyers got absolutely scorched last year as home price appreciation climbed to its highest level in tabulated history.

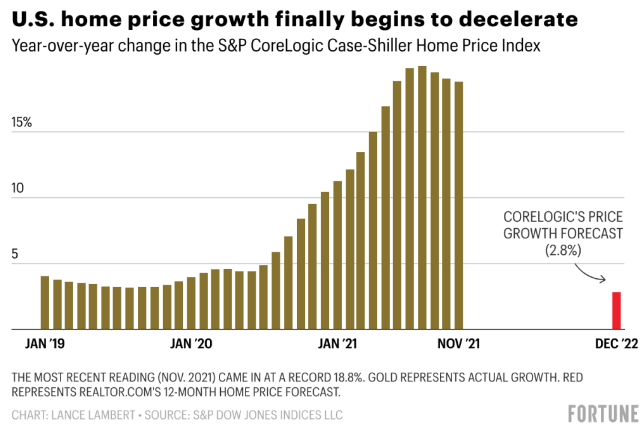

That said, the worst of the run on prices could be behind us. On Tuesday, we learned that home price growth had decelerated for the third consecutive month—after having accelerated in the 15 prior months. According to the S&P CoreLogic Case-Shiller Index, U.S. home prices rose 18.8% between November 2020 and November 2021. That’s down from the all-time high 12-month rate (20%) set between August 2020 and August 2021.

At first glance, this deceleration doesn’t look like much. After all, 18.8% price growth is still off the charts. But when you zoom in to the monthly rate, you see a different picture. See, the latest year-over-year figure still includes the insane 2021 spring housing market—a period that saw U.S. home bidding wars hit an all-time high. Between March and April, the one-month appreciation rate peaked at 2.3%. In our most recent month-over-month period, that rate was just 0.9%. That latter figure would equal 10.4% if the latest monthly rate were sustained over a 12-month period—and that’s well below the current 18.8% top-line growth figure.

MORE HOUSING MARKET NEWS!

ZILLOW CHANGES THEIR FORECAST FOR 2022 – SAYS,” SAYS HOME PRICES TO SPIKE BY 16%.”

MARKET WATCH: Housing Market Predictions for 2022 “Home Price Growth May Return to Normalcy

FORBES: Will Prices Drop?