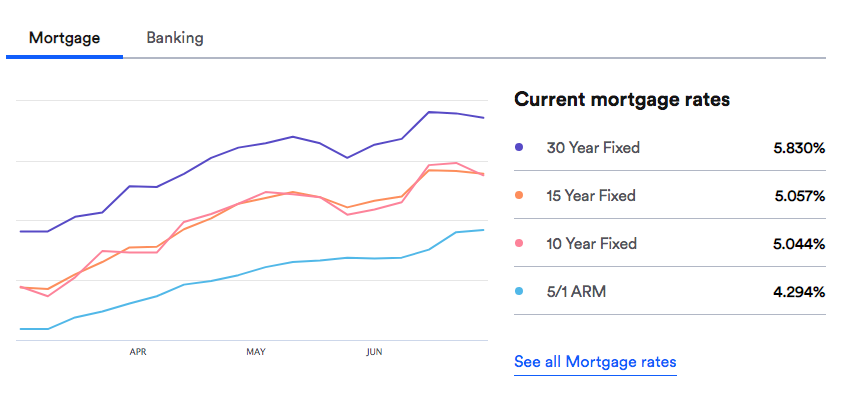

Mortgage rates inched closer to 6% this week. the 30-year fixed-rate mortgage averaged 5.81%, up modestly from 5.78% last week according to Freddie Mac. Borrowing costs are mounting higher and higher for potential home buyers, who may find themselves squeezed both financially and by low inventory.

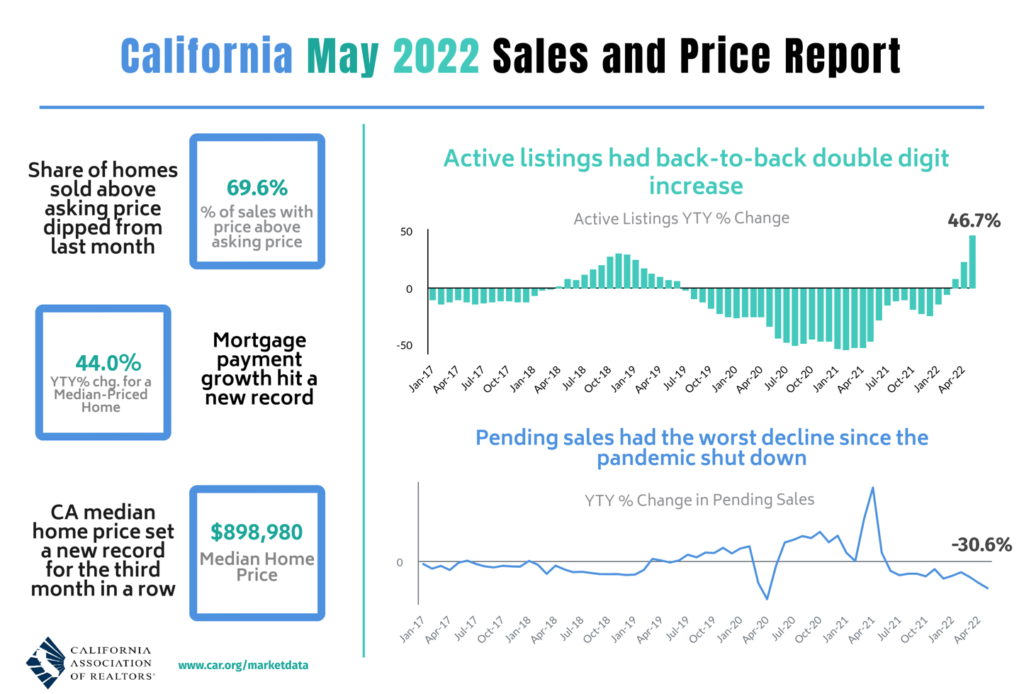

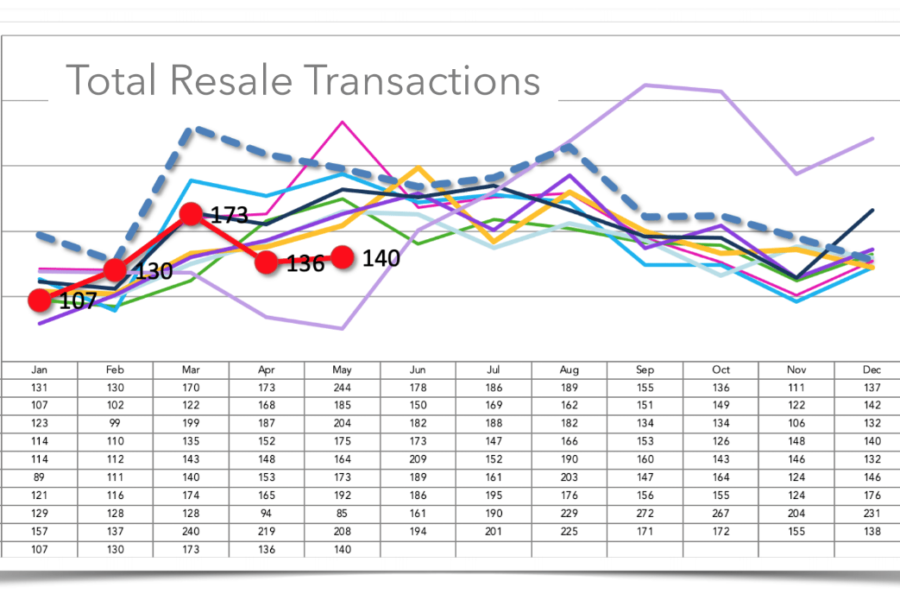

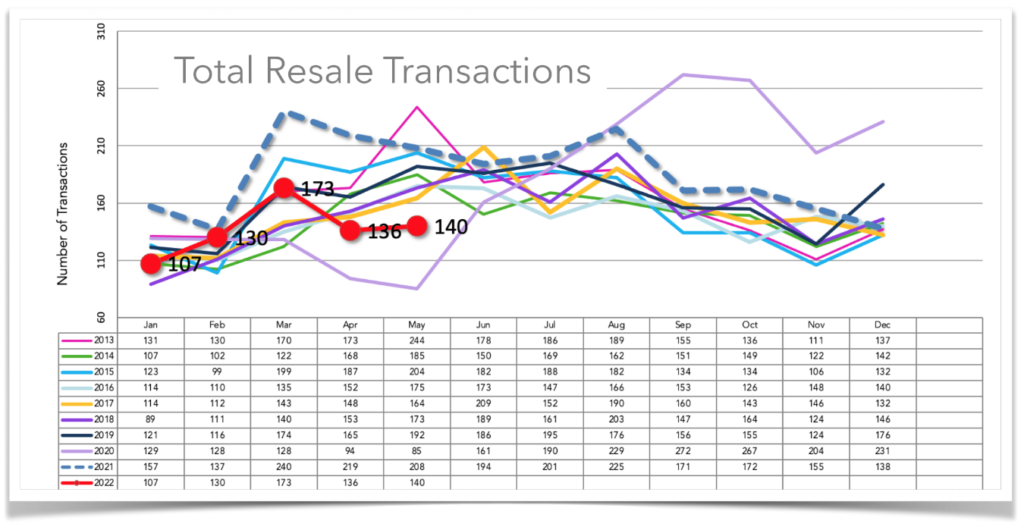

The U.S. housing market is starting to slow after months of record-high home prices, surging mortgage interest rates, and a lack of inventory that has forced buyers into merciless bidding wars. This slowdown could eventually bring home prices down.

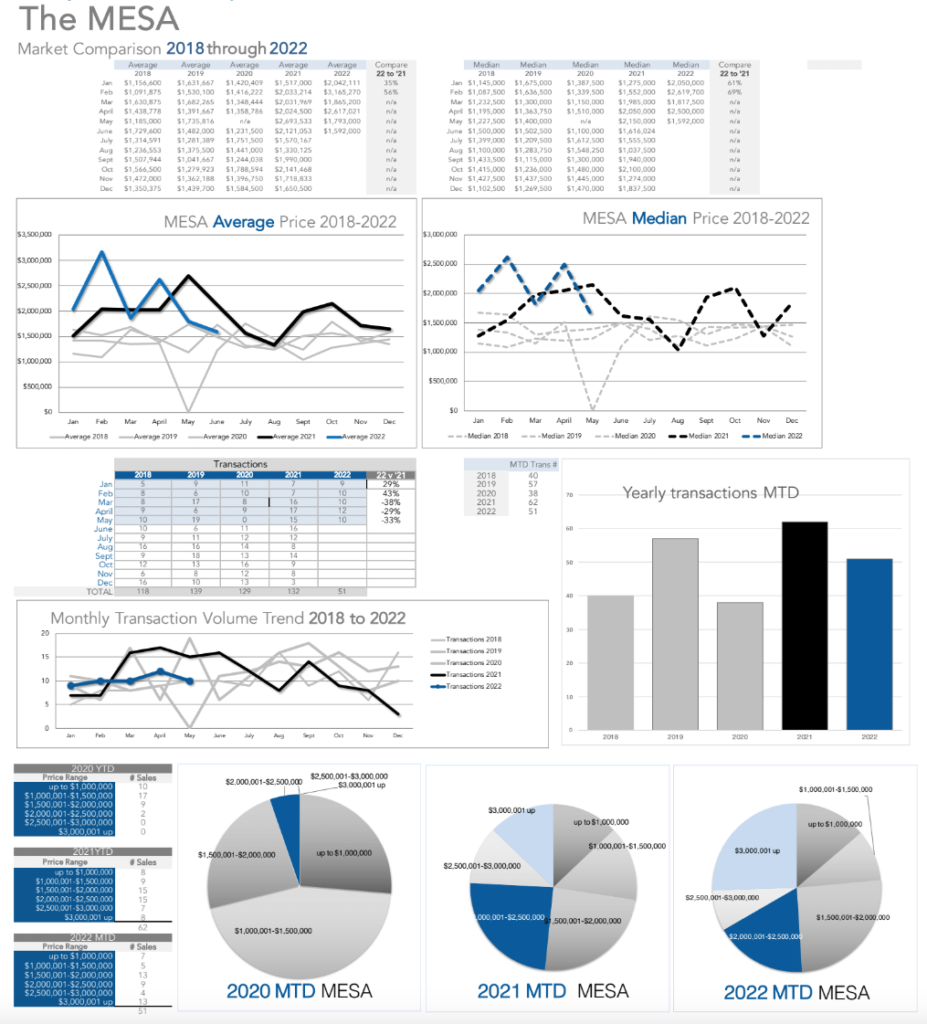

In the first quarter of 2022, home prices have surged by 16 percent on average across the country, according to Moody’s Analytics. But while prices have increased everywhere across the nation, the changes have not been the same in every state.

According to Moody’s Analytics, homes are now even more overvalued than they were during the 2000s housing market bubble. But Moody’s Analytics’ top economists believe that a correction of the market is coming, rather than a crash.