SANTA BARBARA REAL ESTATE MARKET TRENDS

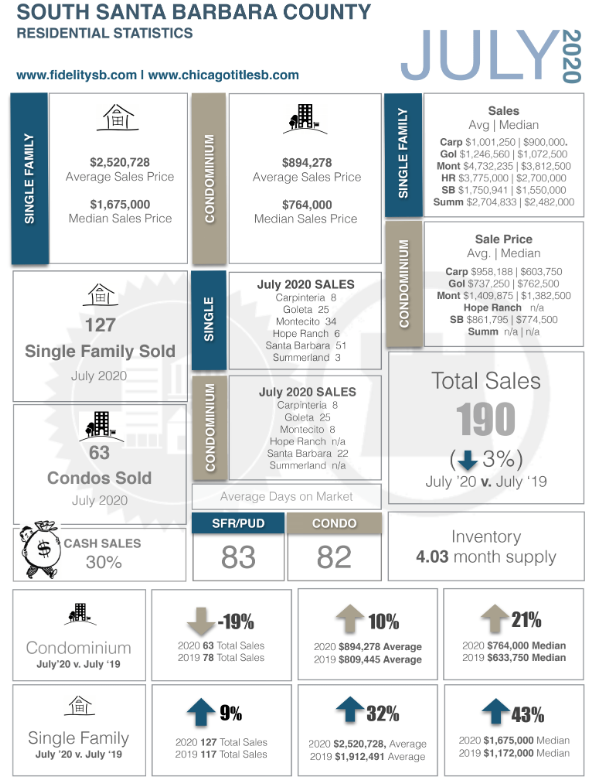

This graph represents the number of homes sold for that month. In May, following the outbreak of the virus here in southern Santa Barbara County 85 homes were sold. In June 161 homes sold, and in July 190 sales. The market appears to be on an upswing which historically is normal for this time of the year.

WHAT’S GOING ON WITH INTEREST RATES?

$1.1 Million JUMBO Purchase (30 Year Fixed): Assumes: Loan Amount GREATER than $765,600 and less than $2,000,000; Credit Score above 780; Owner-Occupied; SFR; APR is 2.92%

*$1.1 Million JUMBO Purchase (7/1 ARM): Assumes: Loan Amount GREATER than $765,600 and less than $2,000,000; Credit Score above 780; Owner-Occupied; SFR; APR is 3.13%

*$800k CONVENTIONAL Purchase (30 Year Fixed): Assumes: Credit Score above 740; Owner-Occupied; SFR; APR is 2.56%

*$500k CONVENTIONAL Purchase (30 Year Fixed): Assumes: Credit Score above 740; Owner-Occupied; SFR; APR is 2.58%

*$450k FHA Purchase (30 Year Fixed): Assumes: UFMIP Financed; Credit Score above 680; Owner-Occupied; SFR; APR is 3.23%

*$450k VA Purchase (30 Year Fixed): Assumes: VA Funding Fee Financed; Credit Score above 680; Owner-Occupied; SFR; APR is 2.43%.

Source: JVMLending