Wall Street Journal – November 14, 2016 “ The remaking of U.S. politics also is likely to upend the nation’s mortgage market. There are two reasons why: Interest Rates and Regulation. Changes in these areas could affect the course of the housing recovery, the availability of credit to borrowers, and the extent to which lenders are willing to take on new risks. It may also affect the current structure of the Mortgage Market, in which Banks have focused on plain vanilla and jumbo loans while non-bank lenders have targeted riskier borrowers, some with more exotic mortgage products.” Click here for the whole article: Home Loans Enter Uncertain Era

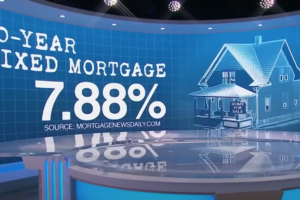

Also in Mortgage News, Donald Trump wins the US Presidential Election, and interest rates shot up. Why? It’s been apparent since September that rates were trending slowly upward. Then on Tuesday night news of Trump’s Presidency hit and slowly turned to swiftly in the blink of an election.

Popular expectations were that a Trump victory would help bond markets and hurt stocks, but, like the election itself the unexpected can happen and interest rates have returned to levels last seen in February. Until President-Elect Trump becomes President Trump rumor and uncertainty will rule markets. And, for the time being, the markets are trading off Mr. Trump’s previous economic policy proposals. Stocks are benefiting because investors feel a Trump Presidency would be more business-friendly with tax cuts, deregulation, and higher defense spending. Bonds are selling off (moving interest rates higher) because President-Elect Trump has promised to impose tariffs and deliver a one trillion dollar infrastructure spending package, both of which could depress productivity gains, increase the Federal Deficit, and ultimately drive up inflation. I guess we’ll just have to wait and see what happens next….phew!