The big question on everyone’s mind is: when will home sales turn around? Are we on the cusp of a double-dip housing recession? Or are there signals that 2024 might see a recovery in the housing market?

Surging mortgage rates and still-high home prices are not leaving already demoralized home shoppers much to be thankful for these days.

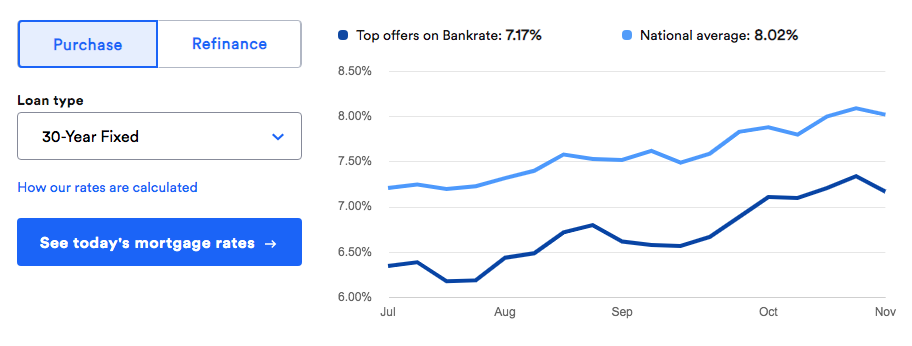

Indeed, the national average 30-year mortgage rate lost a tiny bit of steam the first week of November, but not before rates had already catapulted to a 23-year high of 7.79% by the end of October, according to Freddie Mac.

The 30-year fixed rate eased by three basis points to 7.76% in the week ending November 2, the first bit of relief following seven consecutive weeks of increases. A basis point is one-hundredth of one percentage point.

For some context, mortgage rates were in the low 3% range only two years ago.

In the face of high home prices and rates, monthly existing home sales sagged for the fourth consecutive month. Sales dropped by 2% in September compared to 0.7% the previous month, with all four major U.S. regions posting declines, according to the National Association of Realtors (NAR).

Nonetheless, the housing market remains competitive as demand continues to outpace supply. Would-be buyers with the stomach to stay in the market are gobbling up the limited inventory, especially new homes, as builders continue offering incentives to hopeful homeowners. Source: Forbes

Click the Image Above for More Details

On Tuesday, November 07, 2023, the current average interest rate for a 30-year fixed mortgage was 7.85%, falling 23 basis points compared to this time last week.

If you’re planning to refinance, today’s current average 30-year fixed refinance interest rate is 8.00%, decreasing 16 basis points over the last week.

MORE REAL ESTATE NEWS YOU CAN USE

The Housing Market is Starting to Crack Source: Yahoo

A Prominent Attorney is Seeking 33 Million for this Historic Montecito Gem Source: Robb Report

Famed Santa Barbara Estate Changes Hands Source: Noozhawk