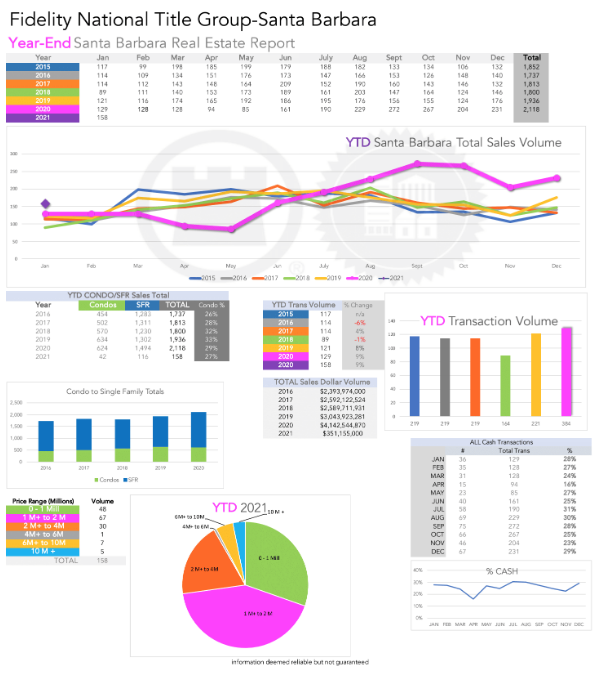

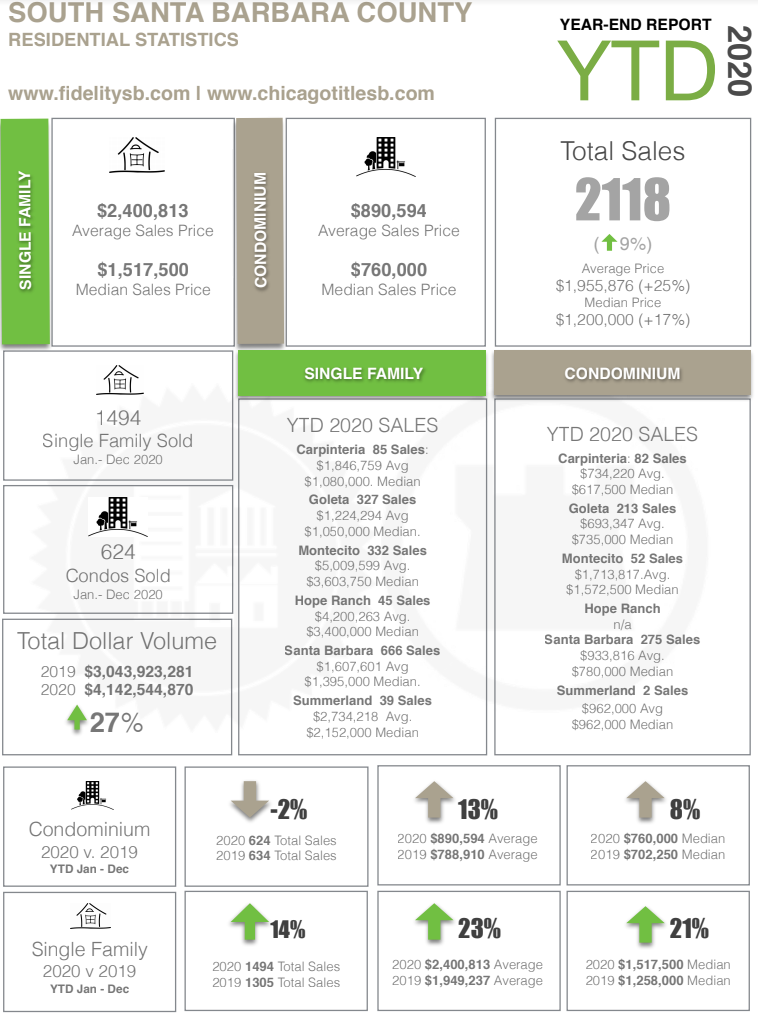

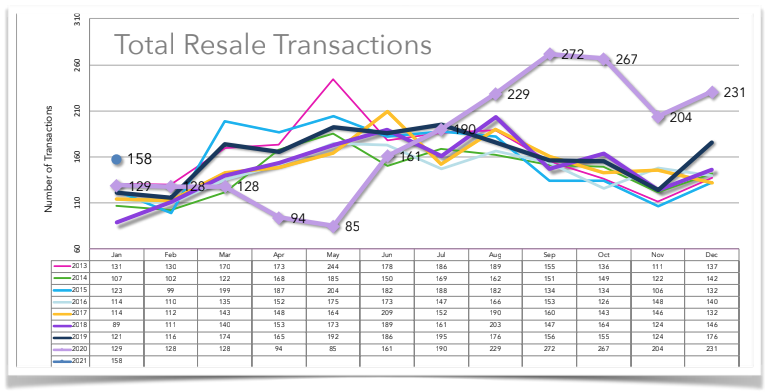

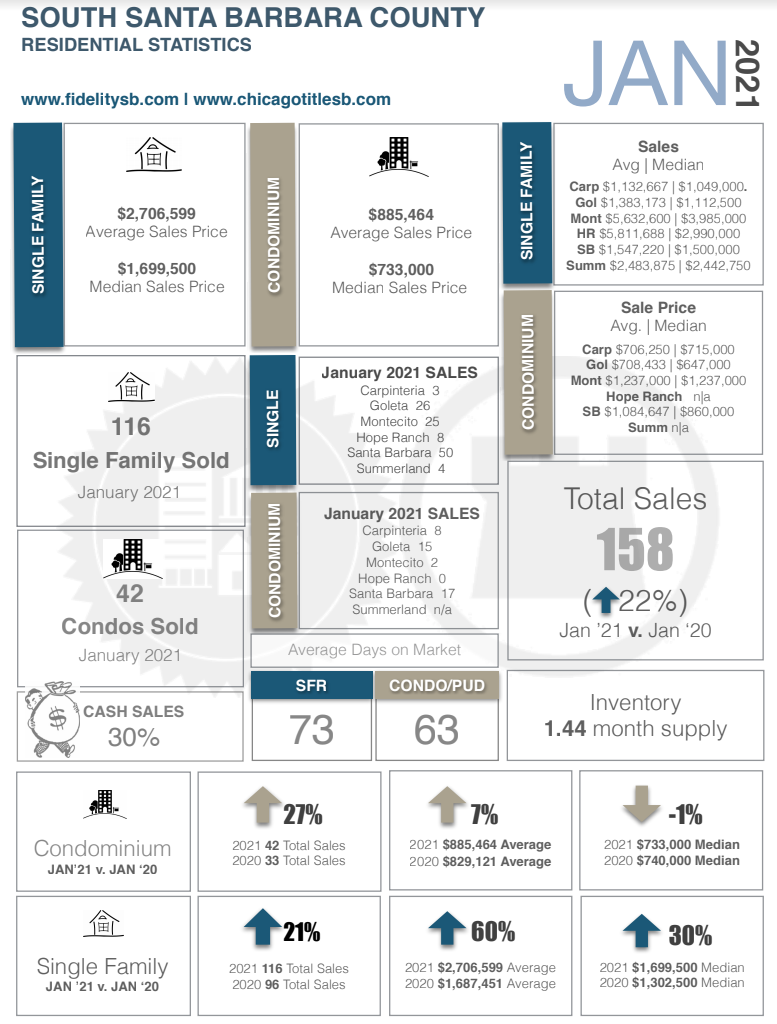

Home sales in all price points took off in June last year here in Santa Barbara and never looked back. This January we experienced 158 home sales.

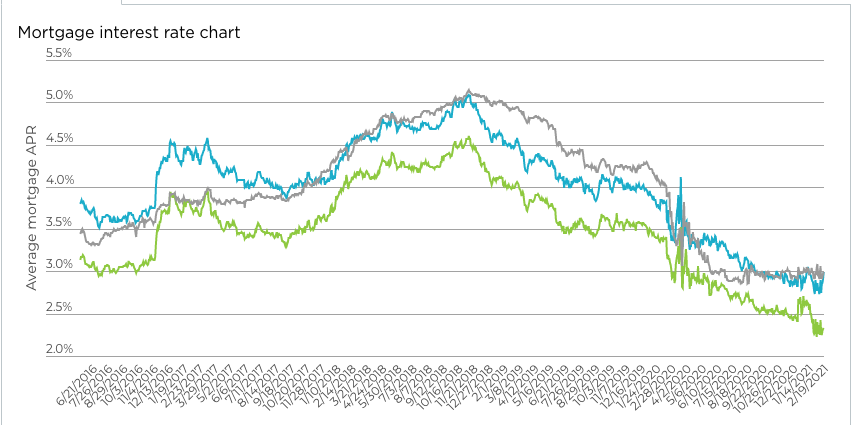

On Thursday mortgage rates rose to the highest level since mid-November, a worrying sign for home buyers navigating a market defined by fast-rising home prices.

The 30-year fixed-rate mortgage averaged 2.81% for the week ending Feb. 18, up eight basis points from the week prior, Freddie Mac reported Thursday. The increase comes after three weeks where the 30-year mortgage rate stayed at 2.73%. The 15-year fixed-rate mortgage rose two basis points to an average of 2.21%, while the 5-year Treasury-indexed hybrid adjustable-rate mortgage dipped two basis points to 2.77%.

Economic spending has improved, due to the most recent stimulus, but supply chain shortages are causing downstream inflation, leading to higher mortgage rates.

The rise in rates was inevitable. Mortgage rates have not risen in tandem with Treasury yields. Historically, mortgage rates have tracked the direction of long-term bond yields.

Throughout the pandemic that relationship has weakened somewhat — with mortgage rates falling to record lows well above those levels, bond yields fell too. That gap has given mortgage lenders some latitude when it comes to adjusting interest rates. But this week, lenders followed suit.

In particular, this week’s strong retail sales report has sparked concerns about inflation. Investors also appear to be increasingly wary that more fiscal relief and accelerating economic growth through increased vaccination rates could translate to higher inflation — something that would reduce the value of bonds’ fixed payments, and possibly lead the Federal Reserve to raise interest rates and place more upward pressure on yields and mortgage rates.

While that remains to be seen, as mortgage rates remain very low by historic standards, this shift in the market’s outlook seems to suggest that the days of all-time low rates may be a thing of the past.

As rates do rise, affordability is going to become an issue for some buyers. Already, a decline in the number of mortgage applications suggests that some Americans have been priced out of the market, as a record-low supply of homes for sale has pushed prices higher.