Unfortunately, we live in a day and age where fraud has become a fact of life. Scams in real estate can vary from mortgage fraud to hackers breaking into real estate and title agents’ emails. Criminals seem to come up with new scams every day. Before transferring funds during a transaction take a moment and check directly – using a verified phone number – to the professional the funds are being transferred to. Your vigilance can make all the difference.

In the Santa Barbara News Press’s Sunday House and Home magazine, a reader asked realtor and columnist Marsha Gray recently, “My elderly mother has owned her home here in Santa Barbara for decades. Ten years ago she took out an equity loan for needed repairs on the house. She’s current with her payments and isn’t struggling. She’s been receiving phone calls from a gentleman who claims there is a government program that forgives Second Mortgages for seniors. He’s pressing her to meet and sign documents to get the process started. It sounds like a scam to me, but she won’t stop talking to him because “he’s so nice.” What do you think? Marsha responded, “Yes it sounds like a predatory scam on an elderly person, contact the Police.”

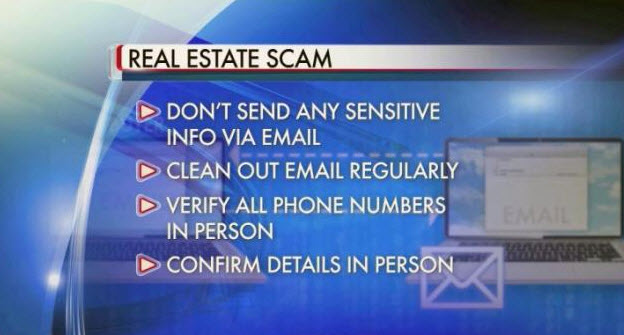

One of the latest scams is criminals hacking into real estate agents or other persons involved in a real estate transaction’s email accounts. The hacker is able to learn clients’ names and Escrow and Title Company information including closing dates, the release of earnest monies when a sale is canceled, and the seller’s proceeds from a sale. The hacker tracks the escrow and at the appropriate time sends false wiring instructions. Buyers should always verify with the Escrow and Title Companies directly before wiring any funds. Attorneys, escrow agents, real estate agents, and title agents have all been targeted in these scams.

Do not let your guard down. Unfortunately these days you need to start with the assumption that any email in your inbox could be a targeted attack from a criminal. If it sounds to good to be true…

Lastly, always buy Title Insurance when you purchase a property. This insures that you’re buying the property from the right party. Unfortunately, there have been more than a few examples of people selling homes they don’t own. One example is (and the names have been changed here) John Smith in Northern California took off for Europe for a year and left John Smith Jr. at home. After they left Junior listed his Dad’s property for sale. Junior sold it and left town. Having the same name as his dad everything appeared fine. When Dad returned from Europe he was shocked to find strangers living in his house. The Title Company took responsibility and the buyers returned their money and Mr. Brown moved back into his property. What happened to Junior is anyone’s guess. This isn’t the stuff of real estate folklore – unfortunately, it’s true. Whenever possible it’s probably best to err on the side of caution.