Santa Barabara Real Estate Insights

The Santa Barbara real estate market in 2025 is quite dynamic and continues to attract buyers with its stunning coastal views and desirable lifestyle. Here are some key insights:

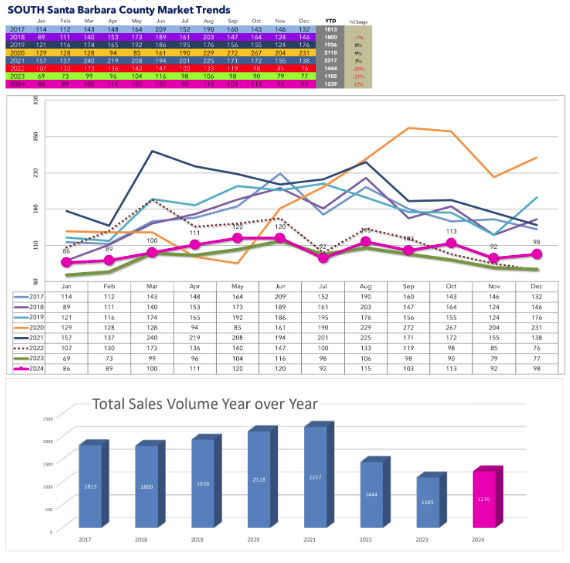

Current Market Trends

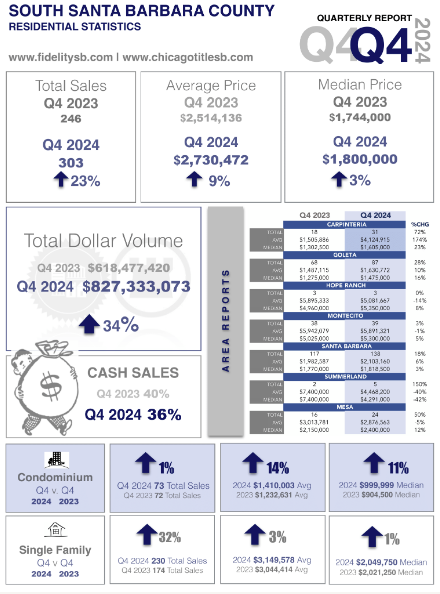

· Median Home Price: As of January 2025, the median home price in Santa Barbara is $1.95 million, reflecting a 7% increase year-over-year.

· Home Sales: There were 38 homes sold in December 2024, a slight decrease from 41 homes sold in December 2023.

· Price per Square Foot: The median sale price per square foot is $1.21K, which is down 2.1% compared to last year.

Inventory and Supply

· Inventory Challenges: Prime areas like Montecito, the Riviera, and Hope Ranch continue to face inventory shortages. However, new construction and aging homeowners downsizing are contributing to modest improvements.

· Supply and Demand: Limited supply in ultra-exclusive areas is driving up prices, while the overall market sees a slight increase in available homes.

Buyer and Seller Insights

· Buyers: Remote work trends are attracting tech professionals and affluent buyers from larger metropolitan areas. Buyers should be prepared to act quickly and work with local agents who have deep community connections.

· Sellers: Highlighting lifestyle features like ocean views and outdoor entertaining spaces can command top dollar. Pricing competitively and investing in staging can help attract buyers3.

Predictions for 2025

· Price Growth: While price appreciation has been significant, 2025 may see more moderate growth rates due to rising interest rates and market stabilization.

· Market Resilience: Santa Barbara’s desirability ensures its market resilience, even as demand cools slightly.

Final Thoughts

The Santa Barbara real estate market in 2025 presents both opportunities and challenges for buyers and sellers. Staying informed and adaptable will be key to navigating this competitive landscape.

The California Real Estate Market 2025

The California real estate market has always been dynamic, and 2025 is no exception. Here’s a snapshot of the current landscape and what we can expect moving forward:

Current Housing Prices

As of December 2024, the statewide median home price in California stands at $861,020, marking a 5.0% increase from December 2023. This upward trend has been consistent for the past 18 months, reflecting a robust market despite economic uncertainties2.

Inventory Levels

The inventory of homes for sale has seen a notable increase, with an 18.4% rise in available homes compared to last year. This increase in supply is a positive sign for buyers who have faced limited options in recent years.

Buyers and Sellers

Buyers are cautiously optimistic, encouraged by lower interest rates and improved housing supply conditions. Sellers, on the other hand, are beginning to re-enter the market, enticed by the prospect of higher prices and increased demand4. The market is expected to see more activity as we head into the spring homebuying season.

Predictions for 2025

Looking ahead, experts predict a continued rise in home prices, with the median home price expected to reach $909,400 by the end of 2025. Home sales are also projected to increase by 10.5%, with an estimated 304,400 homes sold statewide4. However, affordability remains a concern, with only 16% of households able to afford a median-priced home.

Final Thoughts

The California real estate market in 2025 presents both opportunities and challenges. Buyers and sellers alike must stay informed and adaptable to navigate this ever-changing landscape. Whether you’re looking to buy your dream home or sell your current property, understanding these trends will help you make informed decisions.