Historically spring thru mid-summer is the optimal time to put your home on the market for sale in Santa Barbara, and if the pick up in sales lately is any indication that’s proving to be true this year.

Consider this: the heavy winter rains this year created an early super bloom, and the landscape around Santa Barbara is spectacular all of which makes homes and neighborhoods more appealing to buyers. The days are longer and there’s more time for potential buyers to view your home, both during the week and on weekends. There are more buyers out there right now. Spring is traditionally a busy time for real estate with more buyers out actively searching for homes. The increased competition can lead to multiple offers and potentially higher sale prices.

Many families prefer to move during the summer months when school is out which means they need to start their home search in the spring to allow time for closing and moving.

Overall, these factors make spring a favorable time for selling a home in Santa Barbara. However, it’s important to note that the real estate market can vary from month to month (some real estate professionals would suggest that the real estate market reinvents itself every day).

Other factors this year such as the possibility of more bank failures, rising interest rates, the debt ceiling debacle, inventory levels, and other economic conditions can also influence buyers’ perceptions. For buyers and investors in this real estate market, situational awareness is everything.

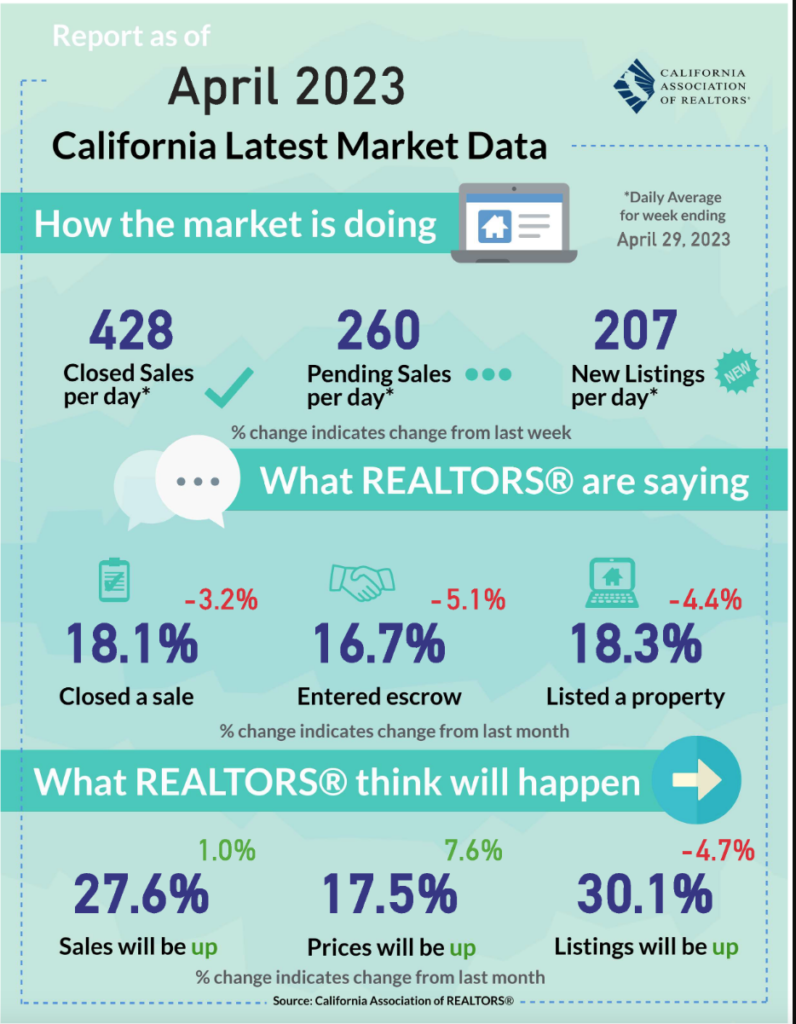

From the California Association of Realtors this week:

News from last week shows the economy continues to grow but doing so at a slower pace. The early reading for Gross domestic product (GDP) of the first quarter of this year suggests that the economy expanded but the momentum appeared to have fizzled out. When looking at retail sales and personal spending, consumers had been holding back despite real income improving nine months in a row. While a strong labor market continues to support wage growth, it also translates into higher labor costs and puts upward pressure on inflation. On top of that, recent bank failures added uncertainty to the overall health of the economy in the long run and suppressed consumer confidence in future expectations. As for the real estate market, the short supply of existing homes for sale steered more home-buying activity into the newly constructed housing sector, which comprised 33.2% of total single-family housing inventory in March – nearly double the 17.8% average in the year before the pandemic.