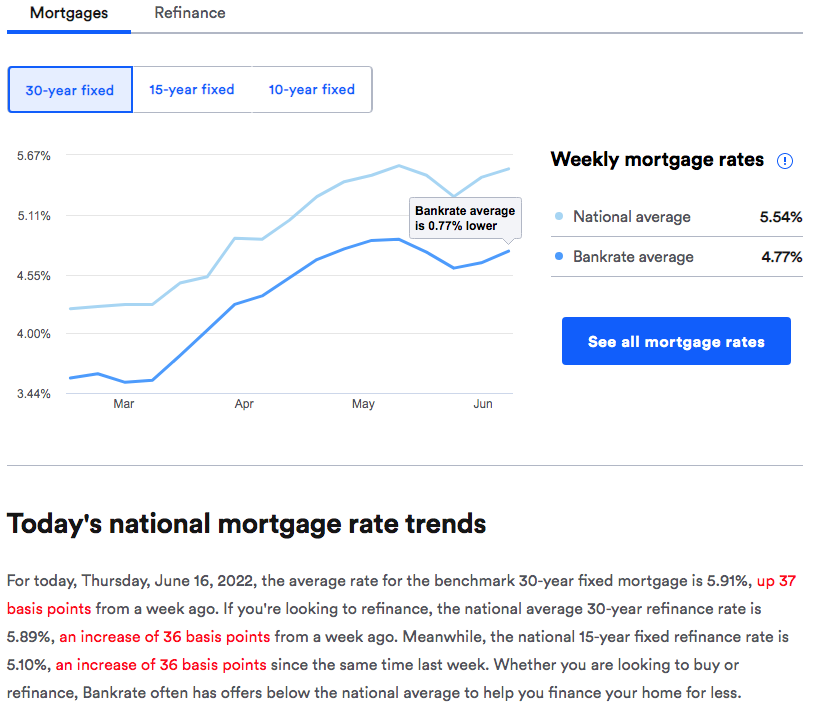

Based on a variety of different factors including stricter standards for lenders, more homes starting to come on the market, and significant fluctuations in home asking prices the average interest rate on a mortgage has remained consistently low for most of the past decade. However, interest rates have started to rise and this may cause some people to reconsider purchasing and wait out this market. In order to help you understand this new phenomenon, we will help explain how rising interest rates are affecting the housing market.

It appears the housing market here in Santa Barbara has peaked. We’re beginning to see what is now being referred to as “Price Improvement,” which I’m guessing, sounds better than ” Price Reduction” which had been the norm for when a seller reduces their original asking price.

If you are looking to move and you need to sell your current home first it’s natural to wonder how rising interest rates might affect you since they play an important factor in determining how much you will have to pay monthly and over the life of your loan. The lower the interest rate the better.

(Watch the video Above as Rebecca Jarvis on Good Morning America explains the impact rising interest rates have on the Housing Market)

What determines rising interest rates on mortgages? Some factors are the state of the economy, the monetary policy of the Federal Government, and current efforts to avoid a recession. If you’re applying for a mortgage your financial and credit history could also affect what interest rate and the loan amount you qualify for.

The best way to understand what’s happening in the here and now regarding mortgages would be to talk to a lender or mortgage broker directly. We can recommend a reputable mortgage broker if you’d like.